Good news, the broader economic improvement is positively influencing corporate learning. Investments in learning strategies, technologies and content appear to be spending priorities, and most enterprises expect to continue their investment in assessment systems, learning management systems and mobile technologies. Performance consulting, however, seems to be declining in importance.

Members of the Chief Learning Officer Business Intelligence Board are asked to provide annual insight into their investment choices. The data presented here are from a board survey on chief learning officers’ investment portfolio examining companies learning investments in what technology and services areas, and where spending will change between 2015 and 2016.

Budgets Are Stable, Increasing

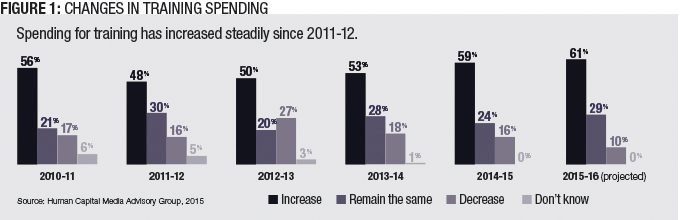

After a couple of years of decline, CLOs report for the third year in a row that their budgets this year were larger than last year. Almost 60 percent of CLOs report higher budgets than 2014, and fewer reported a decline between 2014 and 2015 (Figure 1).

Source: HCM Advisory Group, 2015

Also for the second year in a row, CLOs who saw increases reported an increase of almost 20 percent. Far fewer saw declines, but those CLOs who reported one estimated their budgets shrank by almost 20 percent.

Training budgets look good for 2016, too. More than 60 percent of CLOs expect their budgets to increase next year, and only about 10 percent expect a decrease. Overall, projections indicate training budgets for 2016 will grow about 10 percent on average, with about 30 percent of firms expecting no change from their 2015 budget.

Despite generally increased budgets, CLO’s continue to be thoughtful with spending, focusing on areas that offer the most visible results. For instance, more than half of CLOs expect to increase spending in technology, their content libraries and on strategy (Figure 2). This continues and expands on a pattern from prior years, promoting strong links between learning and business objectives to increase the impact of spending and delivery.

Source: HCM Advisory Group, 2015

Learning technologies, as a priority, will focus on assessment tools and learning management systems for most enterprises, though the mix and breadth of technology used continues to expand. Assessment and evaluation technologies are growing in importance as organizations seek to better evaluate training and promote high performance.

Enterprises are also increasing their spending on performance support technologies. These take on a variety of forms, but the importance of on-the-job assistance is increasingly recognized as an inexpensive way to increase capability in a workforce with expanding responsibilities.

Content libraries are also priorities, with a focus on leadership development. CLOs must prepare the next generation of executives to replace retiring leaders. Combined with mentors and job rotations, leadership development also increases retention rates among mid- and senior-level executives, and helps enterprises ensure the talent and experience they require will be available when it’s needed.

While spending on technology, strategy and content are increasing, outsourcing is showing a continued trend toward stability. After several years out of favor, outsourcing learning services continue to show signs of recovery. For the third year in a row, more learning leaders were expecting to increase rather than decrease their outsourcing budgets.

It’s All About Content and Technology

Consistent with last year’s survey, blended content, e-learning content and leadership and executive development are the significant content areas where CLOs will invest. These areas show an increase in both share of total spending and net growth in spending over the past several years. Compared with the priorities from previous years, instructor-led training continues to decline. This reflects the continued and growing acceptance of e-learning, and the focus on cost effectiveness in other spending areas.

Spending on certification content appears steady, reflecting the continued need to demonstrate relevance and on-the-job applicability but not an increasing demand for the process or maybe the specific content certifications represent. Informal learning content appears to be increasing — acknowledging the preference for informal approaches to instruction, and the somewhat ironic requirement to formalize informal training (Figure 3).

Source: HCM Advisory Group, 2015

In addition to those development and delivery priorities, learning leaders said their content library priorities are leadership and executive development, business skills and general management training: Content areas that help them run the enterprise as opposed to specific skills for specific roles.

Technology is often a major source of efficiency gains throughout the enterprise. This year, like last year, assessment and evaluation technologies are the top priorities. Combining learning management with appropriate assessment and evaluation tools can create a powerful tool for CLOs to target training for maximum benefit.

Overall, 57 percent of CLOs see learning technologies as a significant priority, with a net promoter score of 41 — high priority minus low priority — and nearly 60 percent expect to increase their technology spending in 2016. Technologies are somewhat behind learning strategy as an overall priority — 71 percent say strategy is a significant priority with a net promoter score of 66. That said, data indicates more learning leaders expect to increase spending on technology compared with strategy.

While individual enterprises and CLOs will prioritize their technology spending to support enterprise requirements, the macro trend toward increased assessment and learning analytics suggest an increased focus on ensuring targeted relevance of learning content — essentially making sure learning achieves its intended objectives.

If Money Were No Object

In past years, integrated technology was a popular item on the budgetary wish list. More recently, fantasy items focused on technology to facilitate broader learning and content management. While the consensus has weakened, and there are many more items on the CLO wish list, this year like last year CLOs want assessment and measurement tools.

Source: HCM Advisory Group, 2015

In some organizations, learning technology has been inconsistently deployed — creating inefficiencies or even isolation within the enterprise.

For the first time on this wish list, CLOs are beginning to consider an advanced learning technique with a low commitment footprint: Spaced repetitions. Spaced learning is a technique to reinforce learning content over a long period of time to support recall and knowledge retention. It has strong scientific validity, and tools are now being introduced in enterprise learning to increase the effect of training on knowledge and performance.

Another CLO offered an observation that might serve as a warning, wishing for “change management to calibrate our culture to value learning as an enabler for career success. … Because folks are heads-down focused on work, individual development is not an area people take time for; it is seen as ‘discretionary’ and frankly, a luxury. We have a lot of work to do there.”

Overall, CLOs’ wish list reflects a common theme: to measure and manage high-quality learning experiences and deliver on organizational objectives and values. Fortunately, training investment priorities are generally consistent with enterprise priorities and intentions.

Learning leaders are typically conservative when managing their learning investments. But the priorities in investment areas reflect different approaches to meeting enterprise needs.