In 2012, a rebound in training spending was linked to the economic recovery in the United States. This year the focus remains on items that promote relevance, but with expanded focus on content development and technology enablement.

Investments in training and development continue to grow after notable declines in 2009.

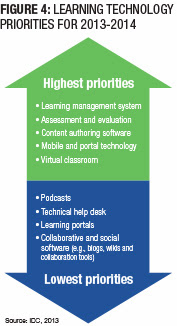

Budgets, which declined in 2008 and 2009 in reaction to the global financial crisis, have grown each year since. Investment in learning technologies and learning content appear to be spending priorities. Conversely, performance consulting seems to be declining in importance. Most enterprises expect to continue their technology investment in learning management systems, assessment systems and content authoring, and want to leverage new delivery modalities such as simulations and mobile learning.

This month IDC surveyed Chief Learning Officer magazine’s Business Intelligence Board on CLOs’ investment portfolios, how companies are investing their training dollars, in what learning technology and learning services areas, and where spending will change between 2013 and 2014.

The Recovery Is Stabilizing

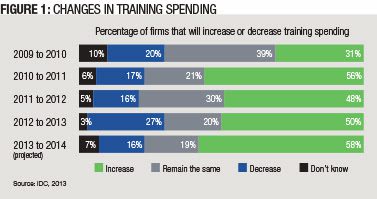

After a couple of years of decline, in 2010 more than half of CLOs reported their budgets were higher than the prior year. This year, more than half of CLOs also report higher budgets than last year. It seems as if the leading edge of the global recovery is continuing to take hold (Figure 1).

In 2012, CLOs who reported an increase estimated that increase at about 6 percent over their prior year budget; in 2013, the average increase was more than 10 percent. But growth isn’t universal. The average for those firms that reported a decline was a 3 percent drop. Though that is a lower decrease than in 2012, not all organizations see an uptick.

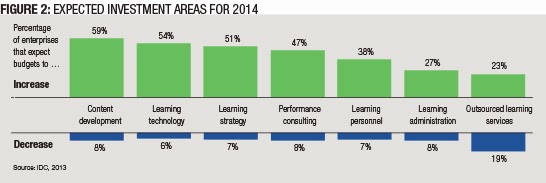

The trend for changes in training budgets looks better for 2014. Almost 60 percent of CLOs expect their budgets to increase next year and only about 15 percent of firms expect a decrease. Overall, training budgets for 2014 will grow — 8 percent on average, with about 20 percent of firms expecting no change from their 2013 budget.

While CLOs will generally see increased budgets, most will focus on improved outcomes and continue to promote linkage between training and business strategy. To do that, they will focus on key investments that support efficiency and relevance.

Where to Spend the Money

CLOs continue to be thoughtful with their use of training dollars, spending most on important areas that offer fast and visible results. For instance, they are significantly increasing their spending on developing in-house content (Figure 2). This reflects a cost-savings attitude and recognition that relevant instruction is critical. Enterprises are also continuing to invest in e-learning and learning technologies — again, reflecting pressures to deliver more content to the widest possible audience.

Some other findings related to budget priorities:

Content development: The focus for content development remains leadership training, which continues to be a priority for large companies. As boomers retire, training and development professionals must prepare the next generation of executives. Combined with mentors and job rotations, leadership development increases retention among mid- and senior-level executives, and helps enterprises ensure the talent and experience they require will be available when needed.

Internally developed training content is also important. Courses are typically related to unique knowledge or processes within the enterprise. As organizations focus on core operations, in-house knowledge and internal expert use will increase.

Learning technology: Learning management systems will be the most significant learning technology investment for most enterprises, though the mix and breadth of technology used in learning continues to expand. Assessment and evaluation technologies continue to grow in importance as organizations seek to better evaluate training and to promote high performance. Enterprises are also increasing spending on performance support technologies.

While these take on a variety of forms, on-the-job assistance is increasingly recognized as an inexpensive way to increase capability in a workforce that might have expanding responsibilities. Virtual classrooms are also an important component in the enterprise training delivery arsenal. E-learning in its various forms offers many advantages, among them flexibility and convenience, and as such this area continues to be a key investment priority for CLOs. Technologies such as simulations and the use of gaming environments may offer new ways to train employees on new topics, but there appears to be limited investment in these technologies across most organizations.

Learning strategy: More than 50 percent of CLOs are increasing their spending on learning strategy. This implies the distance between learning strategies and organizational success is narrowing. Learning strategy has increased in importance during the prior several years.

Outsourced learning services: After several years out of favor, outsourcing of learning services continues to recover. While it is not a large portion of the learning market, firms that do outsource often consider increasing their outsource relationships.

While at the same time spending on content, technology strategy and outsourcing are increasing, two historically strong segments are showing more stability:

Learning administration: Survey results suggest that organizations are attempting to reduce their administrative costs and to focus more energy and spending on learning content delivery. Nearly 3 in 4 organizations are attempting to hold the line on learning administration spending, and 8 percent are decreasing spending.

Performance consulting: Survey results also reflect early stages of a trend toward spending on organizational performance. Forty-five percent of CLOs won’t be changing their performance consulting budget significantly during the next two years, but nearly 10 percent will decrease spending on performance consulting. The learning organization is responsible for establishing and managing change initiatives, and performance consulting has been delivering targeted improvement and increased business value.

Content Focus Remains Stable

Consistent with last year’s survey, blended content, e-learning content and leadership and executive development are significant content areas where CLOs will invest (Figure 3). These areas show an increase in share of total spending and net growth in spending during the past several years. Compared with the priorities from previous years, development of instructor-led training content has become significantly less important to CLOs. This reflects the continued and growing acceptance of e-learning and a focus on cost effectiveness.

Spending on certification content appears to be increasing, possibly reflecting a continued need for demonstrated relevance and on-the-job applicability. Informal learning content also appears to be increasing — acknowledging the preference for informal approaches to instruction and the somewhat ironic requirement to formalize informal training.

Technology has been a major source of efficiency gains in learning and development, particularly in learning administration. For the past several years, learning management has been a top technology priority. This year, assessment and evaluation technologies are also top priorities. Combining learning management with appropriate assessment and evaluation tools can help CLOs target training for maximum benefit and eliminate ineffective training (Figure 4). CLOs continue to invest in their learning technology infrastructures to support wider distribution of learning and to reduce administrative burdens.

A significant percentage of CLOs are planning to increase spending on technology. Some 70 percent of CLOs see learning technologies as a significant priority — with a Net Promoter Score of 44 (high priority minus low priority) — and nearly 70 percent expect to increase their technology spending in 2014. Technologies are similar in importance to learning strategy in overall priority — 75 percent say it’s a significant priority, and 65 percent expect to increase spending next year.

Further, organizations are decreasing their exploration of collaborative technologies, and many are decreasing their spending. On the other hand, more expect to increase their spending on content authoring and mobile and portal technologies, supporting the trend to increase relevance and content accessibility.

Cushing Anderson is program director for learning services at IDC. He can be reached at editor@CLOmedia.com.